I am a firm believer in using data to guide planning. It works.

Community surveys can be powerful tools to help prioritize competing interests, communicate progress, and tap into the collective will of your residents. But they can also be time consuming and expensive for smaller communities with limited staff capacity and budget.

Years ago, in another city, we conducted a community survey every other year to identify key issues among residents, measure our performance, and use the learnings to chart a sound course for our city.

The survey provided valuable information and became an indispensable resource for our city. But the project also became cumbersome. Over time we added questions to the survey that made it too long for some residents. Respondent dropout rates increased. Project costs rose. The survey became tough to analyze and manage on the backend. We spent weeks combing through the data to develop a report for internal use and for residents accessing our website.

Now in a new role at a smaller city, I wanted community sentiment data at my fingertips, but I needed it to be more efficient, more strategic, and more cost-effective. With the opportunity to build my own system from scratch for the first time, I began by researching to find the best way to collect and utilize data for my community.

Through this research, I’ve gathered a few insights on how to successfully develop and conduct a community satisfaction survey. If you are thinking of implementing a new satisfaction survey or would like to review and revise your current system, here is my checklist of basics for doing community research right:

Determining the Approach

Start with a clear understanding of what you want from the data.

Before beginning to determine methodology, design questions, or even outline topics to include, start with developing a vision. Take stock of what avenues and data you already collect, define what you hope to learn from conducting a survey, and most importantly, outline how you plan to utilize the data. This vision will serve as a touchpoint to guide you through the entire process of developing a survey, helping you stay true to your original goal and avoid adding unnecessary complications down the line.

Find a methodology that works best for your community.

I considered social media monitoring, which has become popular for cities of late and has been pursued by many industries for more than a decade as an intriguing way to mine consumer sentiment. A major difficulty with social media analysis is that public sentiment varies widely, can grossly exaggerate the opinions of a passionate few, and is flighty, subject to the emotional whims of the moment. In addition, my smaller community sees less traffic on social media platforms than a larger community might, and social media analysis is very expensive, especially for what I expected to get out of it.

That’s why I returned to quantitative surveys or qualitative research like online focus groups. There’s a sound, systematic process to it that’s proven to give an accurate assessment and rationale to public and employee sentiment. Despite its merits, I’ve also found cons to be aware of, such as:

- Cost. Some research companies charge tens of thousands of dollars, depending on the survey length, number of responses, and backend analysis/reporting. Cost estimates can start low but increase significantly during development as extra features are added.

- Do-it-yourself pitfalls. Despite the rise of good, self-administered platforms like Survey Monkey, at the end of the day, we end up doing the designing, the fielding, and the analysis to save a little money. And I ask myself, are my questions really that good? Is the data actionable? Is it worth the time of our small team?

- Sample. With a smaller population, how am I ensuring that responses are statistically sound for an accurate read of my community? What specific strategies can I employ to include hard to reach residents?

To mitigate these concerns, I decided it was best for my community to search for a research partner that could fit within our modest budget and help design and administer a survey.

Finding the Right Partner

Find an independent researcher with long experience across many industries.

While experience in local government is great, I like to work with a researcher that also has private sector or even global experience. It shows they’re credible and they really know their business. They can bring a fresh perspective, independence, and expertise to city research.

Look for a researcher who collaborates with you.

Each community is unique, and a collaborative approach will help meet your needs and assure you don’t end up with useless data on the backend that disappoints.

Find a researcher who knows how to make streamlined and simple surveys.

A good, streamlined, turnkey community survey with an online dashboard that reports the learnings should cost less than $10,000, and effective researchers know how to do it. Avoid researchers that try to upsell fancy software, response increases beyond what is necessary for a representative sample, or other extra services that expand the cost of your survey.

Developing your Survey

Develop a survey instrument that’s focused on the areas of your city that matter most.

Avoid the pitfall of attempting to squeeze everything into one survey. Prioritize the most prominent issues to keep it under 10 minutes in length. A simple and quick survey will encourage residents to participate again in the future.

Make sure it is designed for mobile.

In my experience, over 50 percent of my residents take the survey on their phones. Research providers often say their surveys work on any device, but are they prioritizing the mobile design? If not, many residents may have a frustrating experience on their phones.

Make sure the research measures performance.

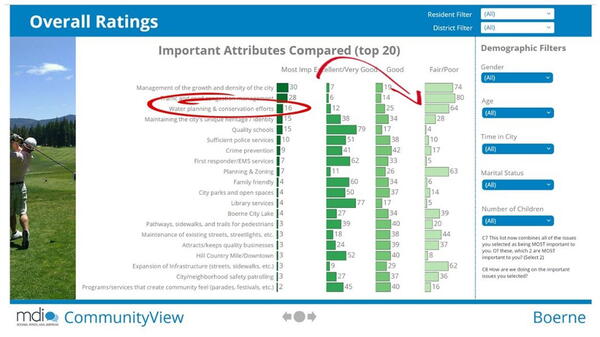

What’s the use of trying to improve when you don’t know exactly where to improve and how your organization is measuring up? In our surveys, we require a gap analysis that measures importance versus performance. Respondents first identify how important a service or topic is to them and then rate the city’s performance. With this information, we are able to quickly identify the largest gaps between our community’s most important areas and performance allowing us to focus our time, energy, and budget to those issues.

Data in Action

Once you’ve conducted the community survey, make sure you’re using that data and it doesn’t “sit on the shelf.”

For example, one of our top gap areas in a recent community survey was water planning/conservation (very important but rated poorly). I talked to my staff and soon discovered how many initiatives we had going on with water planning/conservation. That put me at ease with what we were actually doing and clarified that the issue wasn’t about planning, but with our communication and messaging. We needed to get the word out and showcase our water planning and conservation efforts. Because we weren’t telling the real story, others negatively shaped public perception.

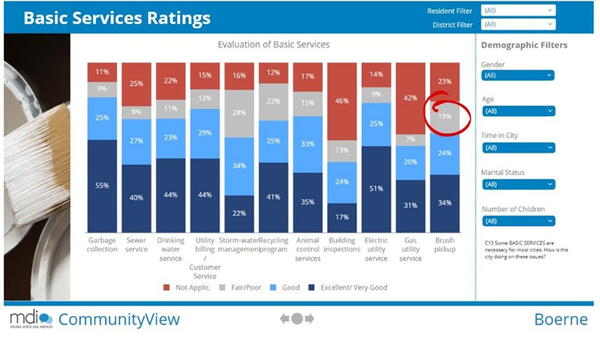

Another example involved brush pick-up. Prior to the survey, a sizeable portion of residents weren’t satisfied and suggested several ways to improve our brush pick-up service. The survey didn’t indicate heavy dissatisfaction across the city, but enough to get my attention. I asked staff from multiple departments to review our current service and come back with recommendations. They recommended that we make no changes to the service, especially since altering the current service would require additional staff and time.

When asked if they had looked at the data from the survey, they said they hadn’t. I asked them to review the survey results and then see what they recommended after that. After reviewing the data and discussing further, their perspective shifted. They came back with a solution that reduced the number of staff hours required to manage the pick-up and expanded the number of options for residents! Having data at our fingertips helped us solve a budding problem in a better, more efficient way.

Be transparent with results by actively sharing them with your community.

Sharing survey results is a fantastic opportunity to connect with your community and build credibility and trust. Celebrate progress on important topics, share specific actions you plan to address low scores, and use the results as a tool to communicate the wide range of services you provide.

Conclusion

Community research lets us focus. It provides facts that compel us to action. In this case, we’re moving forward with initiatives considered in the past that had been left dormant until now. The learnings have now become a strategic source we reference in our city budgeting and planning.

Whether you’re a big believer in research or just considering it, filling in your knowledge gaps with data from a trusted partner will give you confidence that the direction you take is worth your time, effort, and money.

BEN THATCHER is city manager of Boerne, Texas.

New, Reduced Membership Dues

A new, reduced dues rate is available for CAOs/ACAOs, along with additional discounts for those in smaller communities, has been implemented. Learn more and be sure to join or renew today!