ICMA and Savi are working together to help public service employee navigate student loan forgiveness.

Savi is committed to helping public sector employees navigate their student loan forgiveness. Savi identifies the loan repayment programs and gives the information you need to make the right choice.

There are 4 million+ people who are potentially eligible for some form of government loan forgiveness. With Savi, your employees can see a savings of $187 Per Month (average payment reduction) or $38,980 Lifetime Savings (average employee lifetime savings). Satisfaction Guaranteed. If you choose to pay for Savi and aren't satisfied, Savi will refund your purchase.

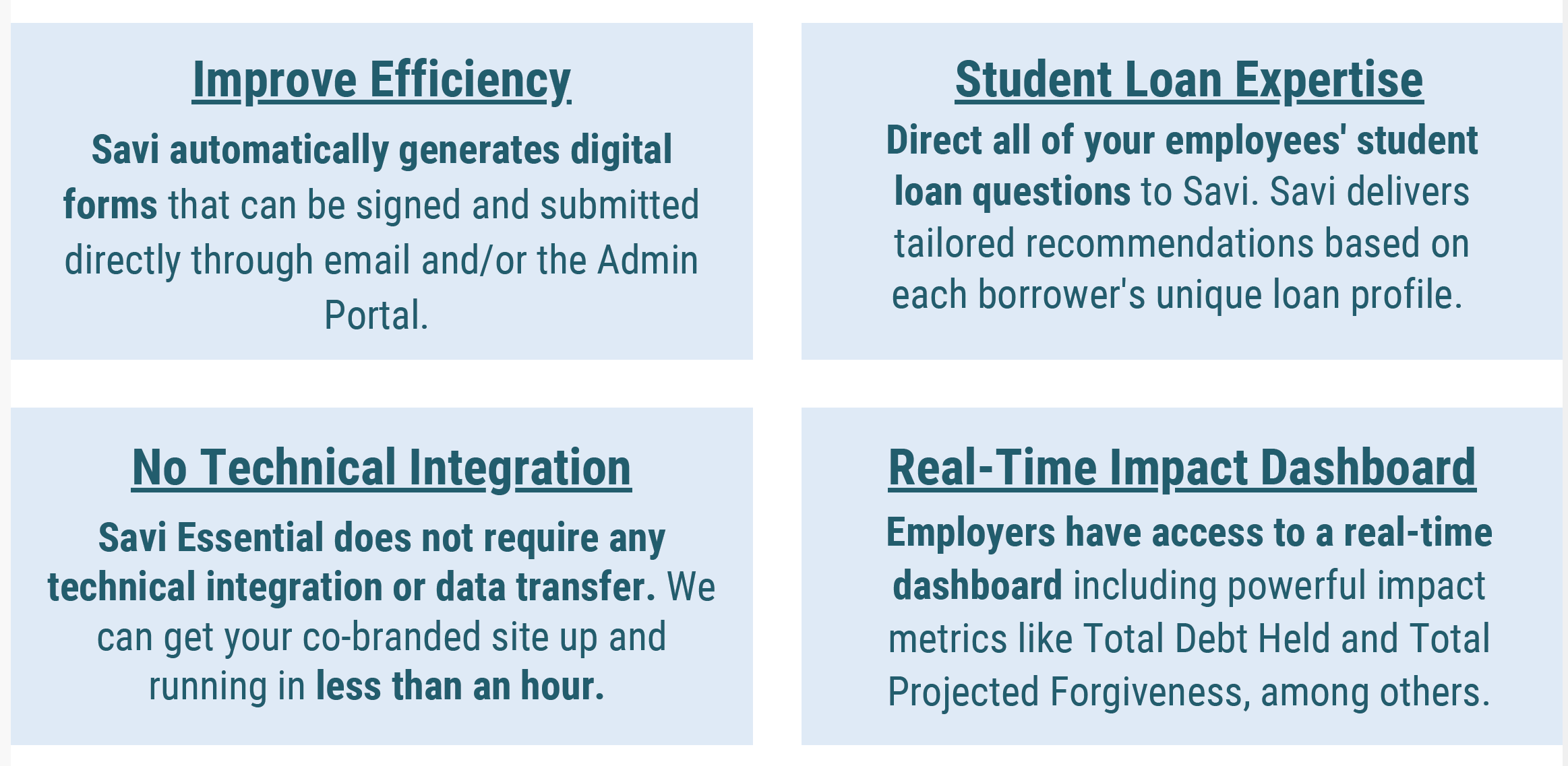

EMPLOYER BENEFITS

When you offer Savi to your employees, you add an attractive financial wellness benefit to your offerings:

Help your employees access student debt forgiveness and savings through Savi.

One consistent concern plaguing recent graduates and early and mid-career professionals is earning enough money to live comfortably while paying back their sometimes crushing student loans. The good news is that it is likely many local government employees qualify for the student debt forgiveness programs that have been making headlines recently. For your organization, you can offer this benefit to your employees, not only helping to reduce your employees’ student debt burdens, as a benefit to help retain and recruit staff. Savi will help you to navigate the various loan forgiveness programs to uncover opportunities to erase or reduce student debt loan payments. On average, borrowers who use SAVI save $187 a month on their student loan payments and $38,980 in projected lifetime savings.

Watch an informational webinar to find out how Savi can help borrowers lower their student loan payments and possibly qualify to have their student debt forgiven.

How our partnership with Savi saves your employees money.

CalculateEmployees sync loan accounts to automatically determine eligibility for student debt relief benefits & loan forgiveness options. | EnrollWith access to a personal concierge, employees receive customized options from 150+ public & private forgiveness & repayment plans. | MonitorSavi simplifies the paperwork & tracking process for both the employer & employee. Employees can easily track their loan forgiveness and make sure they stay on top of annual requirements. |

"I was very excited that my employer teamed up with a service that assists with student loans. I was a first time college graduate in my family. I knew nothing about student loans upon entering school. I sadly did not qualify for assistance due to including my parents income on my FASFA for grants. After completing graduate school, I found myself in over $100K student loan debt. Savi has helped me understand my student loans and assist in making sure I have the monthly payment that is feasible on my monthly income. Additionally, they assisted me with getting connected with Public Service Loan Forgiveness. I knew it was a possible program I could qualify for, but I did not know how to get signed up. I am very grateful for Savi's assistance and quick response to my questions." - Felicia R.

Student Loan Debt Relief Options

Help your employees cut through the red tape & maximize loan forgiveness.

43.5M Americans struggle with student debt.

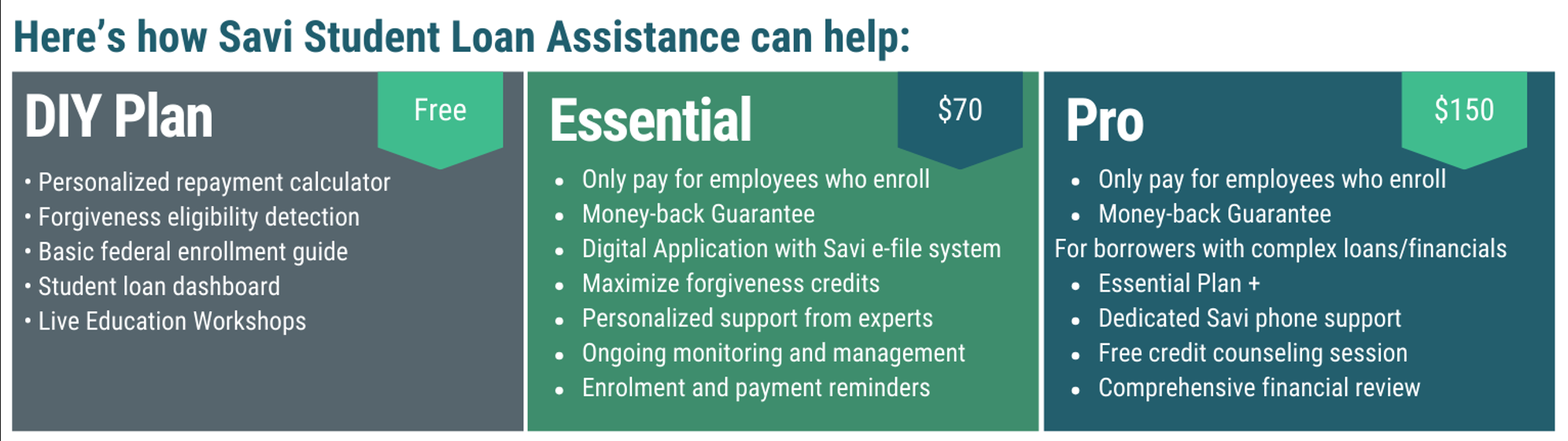

Our concierge program is available as a voluntary employee cost OR city paid benefit.

Public employees also gain access to a FREE student loan forgiveness calculator to help determine eligibility & savings.

ICMA's student debt relief program aims to enrich the lives of your employees and their family members.

If you are a government leader interested in offering Savi as an employee benefit at your organization, please complete this form and Savi will be in touch with next steps. If you are a local government employee interested in accessing this benefit, please share this information with your HR Department, Manager, or Board.