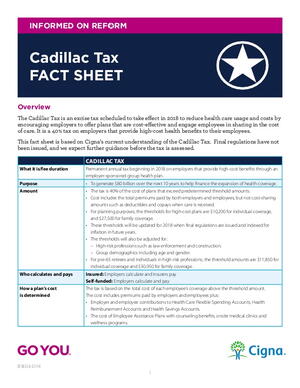

The Cadillac Tax is an excise tax scheduled to take effect in 2018 to reduce health care usage and costs by encouraging employers to offer plans that are cost-effective and engage employees in sharing in the cost of care. It is a 40% tax on employers that provide high-cost health benefits to their employees. This fact sheet is based on Cigna’s current understanding of the Cadillac Tax. Final regulations have not been issued, and we expect further guidance before the tax is assessed.