Having grown in population almost 40% since 2010, Winder, Georgia, USA, is a full-service city of almost 20,000 people and 50,000 utility customers located on the edge of the Atlanta metropolitan area. On June 20, 2020, the Winder city council, comprised mostly of recently elected members, conducted its first meeting with its newly appointed city administrator. At this meeting, the previously prepared 498-page budget for the 2021 fiscal year was adopted. This council expected a higher level of service to be provided to its residents and customers and considered the formula of a new chief administrative officer (CAO) and a new budget year to be the recipe for success. Eight months later, the new CAO and the council were both frustrated. Despite these new beginnings, service quality remained stagnant, and neither council nor its constituents considered their goals or expectations as being met.

As CAOs and members of ICMA, we are called upon to serve our communities drawing from the 14 core competencies considered essential to local government leadership and management. Core competency 12, financial management and budgeting, requires us to “implement long-term financial analysis and planning that integrates strategic planning and reflects a community’s values and priorities; [and to] prepare and administer the budget.” One of the leadership dimensions that contributes to this core content area is “understanding the community and governing body’s priorities and advancing them through the budget and short- and long-term financial planning and management.” This is accompanied by management dimensions that call CAOs and their staff to:

- Implement short- and long-term financial analysis and planning.

- Prepare accurate and understandable capital and operating budgets.

- Provide information for effective budget and financial planning decisions by elected officials.

- Engage in strategic planning to direct the development of goals and the budget document.

- Engage employees across the organization in strategic planning, budget development, and ongoing budget management.

- Measure performance and assess the results of spending.

For fiscal years 2022 through 2024, Winder’s staff leadership has engaged these core competencies and dimensions to lead the mayor and city council in developing and implementing a series of performance-based (or outcome-based) budgets to deliver the vision of the governing body, better serve the city’s residents and customers, and bridge the gap between expectations and resources, all while setting up our staff for operational success in the field. This article is intended to provide a roadmap from the perspective of the city administrator to demonstrate to CAOs and finance directors that performance-based budgeting is achievable in your community and that this method of budgeting delivers real results.

(Mis)aligning Vision with Budgeting

The root of the frustration that Winder was experiencing in 2020, was, as it is for many communities, the misalignment of vision and budgeting. Despite a relatively new council, a new CAO, and a new fiscal year, the spending and revenue plan represented in the budget was not a new beginning. Rather, it was a long and complicated document of line item-based revenues and expenditures, which were segregated and seemingly unrelated to one another, based on previous decisions and historical patterns, which was failing to deliver expectations. The 498-page document was in a form considered incomprehensible to most of the elected officials, the staff charged with its implementation, and the community it was meant to serve.

The solution was a bold initiative led by the CAO, beginning in February 2021, with support from the CFO and operational department leaders, to engage the governing body in a series of discussions intended to clearly articulate the policy and service expectations of the council, residents, and customers of Winder. We would then align those expectations with revenues and expenditures in the next fiscal year’s budget through performance-based budgeting.

Introducing Outcome-based Budgeting

Even communities without written strategic plans and adopted financial policies (which included Winder at that time) have unwritten understandings of the type and quality of services and financial tools that are considered the most expected and the least desirable. For example, the public works team must maintain city facilities immaculately; and we don’t raise property taxes here.

Outcome-based budgeting, also known as performance-based budgeting, is the process of aligning available resources (revenues) with available funding (expenditures) and expected outcomes (type and quality of services to be delivered by the local government) in agreement with the policies, value systems, and agreeable price points of the residents served as articulated by the governing body.

Although this seems daunting, performance-based budgeting actually simplifies budget discussions by clearly defining outcomes and resources. We found that the secret to success is a step-by-step approach that the CAO and CFO can take with elected officials, staff, and residents for incredible results.

Step 1: Articulate Desired Outcomes

CAO works with elected officials to articulate outcome expectations that align with strategic goals and financial policies.

What builds frustration in traditional line-item budgeting processes is what eliminates frustration in performance-based budgeting: the act of defining clear outcome expectations that are meaningful and measurable. Winder found clarity in a series of discussions held by the governing body — led by the CAO and carefully observed by the CFO — to identify, articulate, and define meaningful and measurable outcome and service delivery expectations beginning in February 2021 and continuing throughout each of the subsequent two fiscal years.

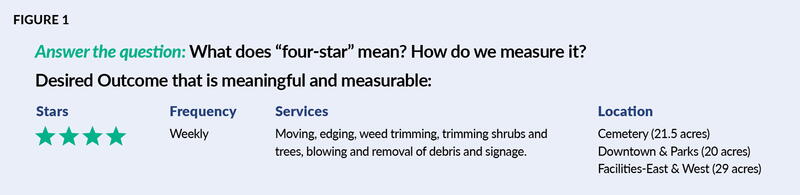

An early service expectation identified by council was “improving public works.” Through a series of discussions, the CAO and public works department leader worked with council to translate “improve public works” from a vague directive into a strategic goal: “enhancing paving and public works programming, including downtown landscaping, parks, right-of-way maintenance, road paving, pothole patching, and a full sign replacement program.” Further discussions enumerated that strategic goal into outcomes that are clear, articulatable, meaningful, and measurable. For Winder, that included developing a four-star system of grounds keeping and right-of-way maintenance that defines the frequency and details of service (see Figure 1), and then assigning a star level of service to each of Winder’s public spaces, facilities, and rights of way.

Step 2: Determine the Cost

CAO works with operational and finance staff to determine the cost to meet the desired outcome.

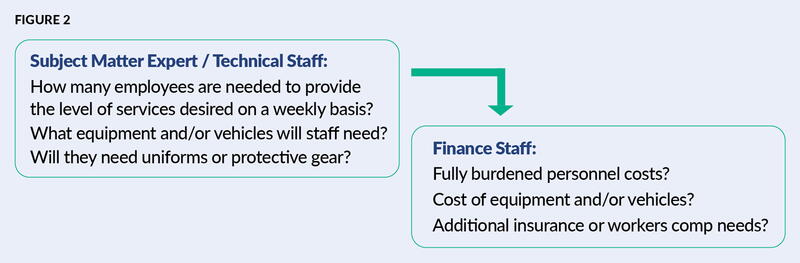

Once the governing body has defined the desired outcomes for the service area clearly enough for the staff to articulate in detail, step two is to calculate the cost of delivering the defined outcome.

If four-star maintenance is desired for all city rights of way, staff should identify and estimate the cost of each element of delivering this directive. Questions must be asked and answered by the operational staff. For example:

- How many miles of rights of way are within the city?

- What equipment is needed to perform the four-star maintenance regimen of mowing, edging, trimming, blowing, and removing debris and signage?

- How many staff members are required to perform this regimen for each mile on a weekly basis?

- What training, safety gear, uniforms, tools, and fleet will be required?

While the operational staff delivers and calculates the operational data and cost, the finance team provides the fully burdened personnel cost, such as wages and benefits, and other allocated costs, such as insurances and dues. Added together these figures calculate the cost of delivering the desired outcome articulated by the governing body.

Step 3: Identify Resources

CAO works with CFO to identify available funding resources and calculate equivalents.

In step three, the CAO and the CFO identify available funding resources appropriate for allocating to each of the governing body’s desired outcomes. Appropriate resources may be defined by state laws restricting usage of certain revenue streams, prior restrictions placed on revenues or funds, and the written and unwritten financial policies and goals of the community. These can include property and other taxes, fines, fees, investment incomes, debt financing, and other special revenues. For example, Winder’s council aimed to keep property taxes low, to keep only generally available services (such as public works, police, and fire) subject to tax support, and to move services for individual recipients to a cost recovery fee-based system.

Once available and appropriate revenues have been identified, the next step is to equate the cost (step 2) of delivering that outcome to an equivalent metric for that revenue. For fee-related services, this may equate to a cost per service or a millage rate for a property tax supported service.

For Winder, public works is a generally available service supported by property taxes. The council identified the desired outcome as four-star treatment to the city’s Rose Hill cemetery, downtown area, parks, and city-owned facilities on the east and west sides (a combined 60.5 acres). Public works and finance staff calculated the fully burdened cost equated to .95 mills in property tax collections.

In Step 3, outcome-based budgeting asks and answers the question, ”what are taxpayers buying with their tax dollars?” and allows policymakers to make fully informed decisions on outcomes and priorities.

Step 4: Funding the Gaps

CAO and CFO identify alternatives to meet funding gaps.

It is to be expected that the cost of meeting desired outcomes will exceed the revenues available. Therefore, it is the professional responsibility of the CAO and CFO to prepare alternative considerations for the governing body.

For the CFO, where and how can revenues be increased? For example, are there opportunities to move services from general tax support to a fee-based system? If so, what are these services and how much would a cost recovery fee system generate to support desired outcomes in those areas? How much tax revenue would such a move make available for generally available services? Are there fees already in place that can be adjusted to meet funding gaps? Can certain tax rates be adjusted? Are some funds restricted that can or should be relieved of this restriction? Is debt an option worthy of consideration?

For the CAO, are there service delivery alternatives that can be considered by the council that are within existing funding constraints? Can phased approaches to desired outcomes be implemented? Are there service areas that should be considered for addition or elimination from the local government’s service delivery given the strategic goals and funding constraints of the community?

Step 5: Convene the Elected Officials

CAO and CFO present the fully burdened cost projections, available resources, funding gaps, and alternatives to elected officials in a comparative format.

Step one requires the CAO and CFO to carefully dialogue with and listen to the elected officials in order for the staff to then conduct steps two through four. Step five brings the team back together, this time with staff demonstrating to the governing body that the vision has been fully understood and contemplated for budgeting and implementation. However, once staff has presented the findings of steps two through four, step five is for the elected officials to grapple with the distance between its desired outcomes and the community’s financial ability and/or willingness to deliver them. This is the work of the policy makers, engaging in meaningful and consensus-building discussion to determine priorities and manage wants. It will be critical at this stage for council to discuss and compromise both among themselves as to expectations, wants, political tolerances, and constraints, as well as to decide between competing priorities across the organization (e.g., fire is as important as police; we want events, but must have sanitation). By definition, outcome-based budgeting doesn’t allow for across the board increases or decreases, but moves local government services to quantifiable results, outcomes, and impacts.

Finance and operational staff should aid council in their discussions, but not advocate for positions, outcomes, or funding. Rather, the CAO’s and CFO’s role here is to equip elected officials in their discussions, ensuring premises for decisions are based in accuracy and are operationally achievable. CAOs should assist council in this step by identifying common threads of agreement in discussions, and along with the CFO, continuously quantifying discussion points in order to assist the governing body in reaching an agreed-upon list of measurable, meaningful outcomes paired with available and identified resources that will culminate in an approved budget document.

Step 6: Adoption and Implementation

Accountable for Delivering Outcomes

Once the CAO and CFO have delivered a budget document reflective of the decisions made by the elected officials in step five, and the governing body has approved that document, the CAO and CFO must now train, equip, and lead the operational staff in achieving the desired outcomes articulated within and funded by the performance-based budget.

Financially and operationally, both successes and failures are easy to identify in the execution of performance-based budgeting, therefore accountability is a notable consequence of aligning revenues and expenditures to performance outcomes. Throughout the budget year, the CAO and CFO must continually monitor the operational and financial actuals against what was projected and recalibrate when performance, cost projections, or revenues miss the mark.

Is It Worth It?

Preparing the first performance-based budget for a community is a complex and time-consuming task, but not an insurmountable one. Communities don’t have to start with an organization-wide approach. You could try tackling one strategy or area of operation at a time in retreat-like gatherings, rather than budget meetings, where staff and elected decision makers have the time and focused attention to thoroughly discuss and dialogue both frustrations and expectations.

Be prepared for challenges in defining expectations, so use commonly accepted criteria where you can to define the details in performance outcomes. (For example, an award your community wants to receive, or a certification status a department wishes to gain.) Prepare your staff by helping them gain technical knowledge of cost measures and the management and leadership skills necessary to gauge what their staff teams can reasonably deliver. Be forthcoming about realistic expectations with elected officials. In each conversation and presentation with residents, staff, and elected officials, be connecting the dots between performance, expenditure equivalents, revenue constraints, and the trade-offs required by each.

Winder is in its third year of performance-based budgeting with great results. City councilmembers comprehend the budget document, support what the revenues and expenditures represent within it, and can intelligently converse with each other and the community about expectations, costs, priorities, and trade-offs. Staff understand what results they are accountable for delivering and feel set up for success. Residents and customers are receiving improved services at price points that staff and council can explain and demonstrate.

Furthermore, Winder’s fiscal health has never been stronger as performance-based budgeting has also allowed the city to engage in longer-term financial planning and to build reserves. New expectations require new approaches. For Winder, that was the move from traditional line item-based budgeting to performance-based budgeting with meaningful and measurable outcomes.

RACHEL BEMBRY, CPA, is chief financial officer of Winder, Georgia, USA, as well as vice president of government services for JAT Consulting Services.

MANDI CODY, JD, ICMA-CM, AICP, is the former city administrator of Winder, Georgia, USA. She is currently principal of Momentum Results, LLC.

New, Reduced Membership Dues

A new, reduced dues rate is available for CAOs/ACAOs, along with additional discounts for those in smaller communities, has been implemented. Learn more and be sure to join or renew today!