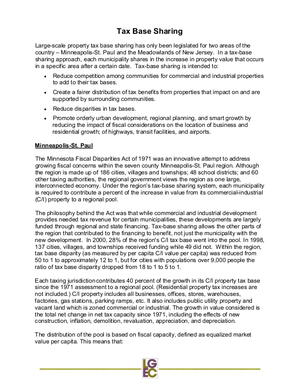

Another report from the state of New York's Commission on Local Government Efficiency and Competitivenesss, this paper deals with the possibilties of sharing municipal property tax gains after certain dates. This entire idea is seeking to remove the more corrosive aspects of competition between local governments when seeking corporations and businesses to be based in their town (and thus on their tax jurisdiction). The rationale is to remove the all-or-nothing approach which arises all too often from this (taxes skyrocket with an incoming business, but collapse to zero when the company leaves), and instead provide even shares to multiple local governments.

As drawn from here.