by Rebecca Torvik, ICMA

Many local governments are making efforts to reduce government employee healthcare costs, but engagement levels in these programs remain low due to employee’s limited time and lack of awareness, as well as insufficient engagement program funding. This comes from last year’s survey conducted by ICMA, in collaboration with Cigna, to learn more about the current state of U.S. local government employee healthcare programs. Human resource directors of local governments were surveyed about health insurance types, benefits offered, cost-reducing approaches, and engagement level obstacles. The survey’s goal was to evaluate the condition and challenges of health insurance programs.

Health Insurance Survey Findings

The survey results offered insight into the makeup of government employee healthcare packages and cost-reducing actions. Respondents revealed that 99.7% offer medical insurance and of those, 88.6% stated that local government pays for some or all of the benefit. Respondents also reported that almost half of local governments that offer health insurance purchase plans from an insurer and 42.0% offer self-insured plans.

In a 2011 ICMA survey addressing local government employee health insurance, only 25% provided high-deductible plans with a stand-alone health reimbursement account (HRA) or a health savings account (HSA). In the 2016 survey, 42.9% now offer a high-deductible medical plan with a health savings account; and of those that do not offer it, more than three-fourths reported that they might in the next one or two years.

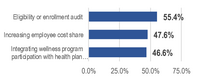

Since reducing healthcare costs is a major concern for most local governments, respondents were asked to identify which approaches they were taking to reduce health insurance expenses and claim costs. The three most common methods being implemented are

- Auditing or reviewing health plan eligibility or enrollment.

- Increasing the total share of health care costs paid by active employees, through premiums, copays, deductibles, etc.

- Integrating employee participation in wellness programs with health plan data.

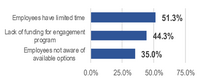

While local governments are taking steps to reduce healthcare costs, employee engagement levels in health-related services remain a barrier. In ICMA’s 2011 health insurance survey, 65% of respondents said that lack of employee engagement was an obstacle that limited their local government’s success in developing a healthy workforce. To further examine this challenge, the 2016 survey asked human resource directors to identify reasons for low engagement levels. The three most common reasons were

- Limited employee time for engagement.

- Lack of funding to properly implement an employee engagement program.

- Lack of awareness of available options.

The survey also revealed that the employees who are aware and engaging in these health insurance programs are predominantly retirees. On average, retirees account for almost one-fifth of the total number of individuals receiving medical coverage from responding local governments. However, the health benefits needed for these individuals are not always offered. Respondents reported that only 60.6% of early retiree plans offer medical Insurance and 32.9% of retiree plans offer the same medical insurance as active employees to retirees age 65. Additionally, only 10.3% of retiree plans of local governments offer Medicare advantage and 21.4% offer a Medicare Supplement. Retirees are a segment with high participation in health care services, but the necessary benefits offered to them are often limited.

New, Reduced Membership Dues

A new, reduced dues rate is available for CAOs/ACAOs, along with additional discounts for those in smaller communities, has been implemented. Learn more and be sure to join or renew today!